New home depreciation calculator

Help with 1031 Exchange. D P - A.

Free Macrs Depreciation Calculator For Excel

Step two - Subtract depreciation charge from current asset value to get the remaining balance.

. So with a 30000 new vehicle youre basically throwing 3000 out the car window as you drive the car home for the first time. It is a common myth that older properties will attract no depreciation claim. Its often overlooked or ignored when buying a new car but for many depreciation is the single biggest factor affecting running costs adding more to cost per mile than fuel.

The average car depreciation rate is 14. Buying a Mazda CX-5 New vs Used. CEVS rebate is only applicable for cars registered after 1-Jan-2013.

S Reg Date. Especially since it applies to both new and used property its. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Repairers builders and home inspector associations and insurers. If youre unsure of what information to enter refer to Depreciation - a guide for businesses IR260 and the General depreciation rates IR265. If you did not when you sell your rental home the IRS requires that you recapture all allowable depreciation to be taxed ie.

S CEVS Rebate. Calculate the monthly instalment on your new car based on the car price and loan interest rates from major lenders in Singapore. A P 1 - R100 n.

New car replacement insurance costs extra but drivers worried about depreciation may want that coverage to protect them if their new car gets totaled. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Top 10 vehicles with the highest. For instance a widget-making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty transmission. The following article will explain the.

A depreciation schedule is the best way to ensure the biggest tax refund possible. These items have been filtered to our Roofing category. Input details to get depreciation.

Calculate the monthly instalment on. Clay or Concrete Tile. Depreciation is simply the difference between the amount you spend when you buy a car and the amount you get back when you sell or trade it in.

For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. A BMT Tax Depreciation Schedule covers all deductions available over the lifetime of a property. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange.

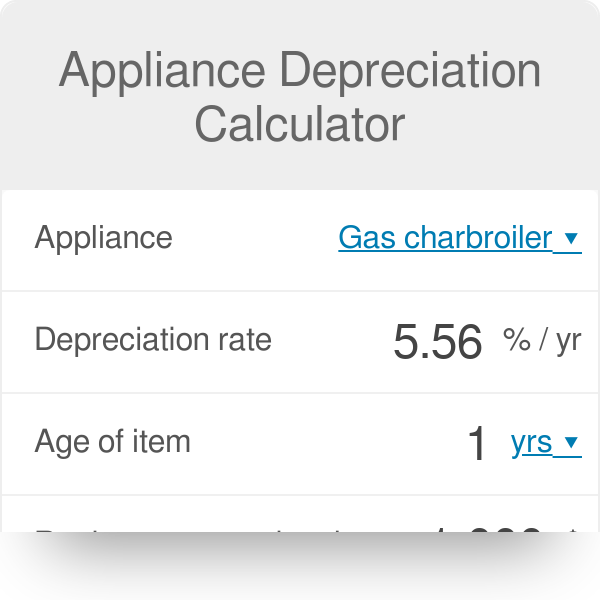

However both new and old properties will hold some depreciation benefits. Request a tax depreciation schedule quote BMT has completed more than 800000 property depreciation schedules helping Australian taxpayers just like you save thousands of dollars every year. Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered.

All about the Percentage Depreciation Calculator. Useful Forms for Sellers. Including the depreciation you did not deduct.

So if you did not depreciate in past years you can still amend the last 3 years tax returns 2018 2017 and 2016 to claim that depreciation. Balance value then will be used as asset value for next year and new balance value will be calculated to be used in the year after that and so on. New Car Instalment Calculator.

Call our expert team today on 1300 728 726 or complete the form below to find out how we can help you maximise the deductions from your investment property. This rate finder and calculator can only be used for assets other than buildings acquired on or after 1 April 2005 and for buildings acquired on or after 19 May 2005. Leave blank if there is a CEVS surcharge.

Car Depreciation Calculator. How to Know What Your Car Is Worth. New Tactics to Watch in.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. Balance 3000 - 300 2700. Your vehicle can be new at purchase or second hand and we will calculate the depreciation based upon age and mileage.

Estimate the depreciation of a new or used vehicle based on our modelling data or enter your own depreciation rate. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. If you purchase a used Mazda CX-5 that is 2 years old then you could save 3073 compared to buying new and still have a relatively new model with plenty of useful life remainingIf you plan to keep this vehicle for 3 years then your total cost of depreciation would be 5395Try other age and ownership length combinations or different.

Home Resources Depreciation Used Car Finder. The Car Depreciation Calculator uses the following formulae. The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate.

Depreciation Used Car Finder. The Depreciation Calculator computes the value of an item based its age and replacement value. A brand-new car loses somewhere between 911 of its value the moment you drive off the lot.

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Personal Asset Depreciation Calculator Fix Your Budget Woes Online Budgeting Tools Budgeting Online Calculator

Depreciation Schedule Template For Straight Line And Declining Balance

Straight Line Depreciation Calculator Double Entry Bookkeeping

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

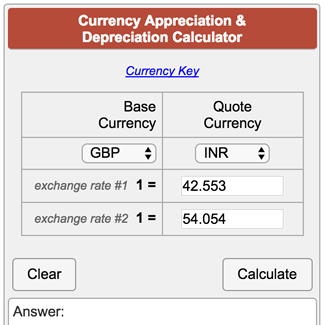

Currency Appreciation And Depreciation Calculator

How To Calculate Property Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Awesome How Much Will A New Car Depreciate In 3 Years And View Best Quotes New Cars Bike Prices

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Of Fixed Assets In Your Accounts Marketing Process Accounting Small Business Office

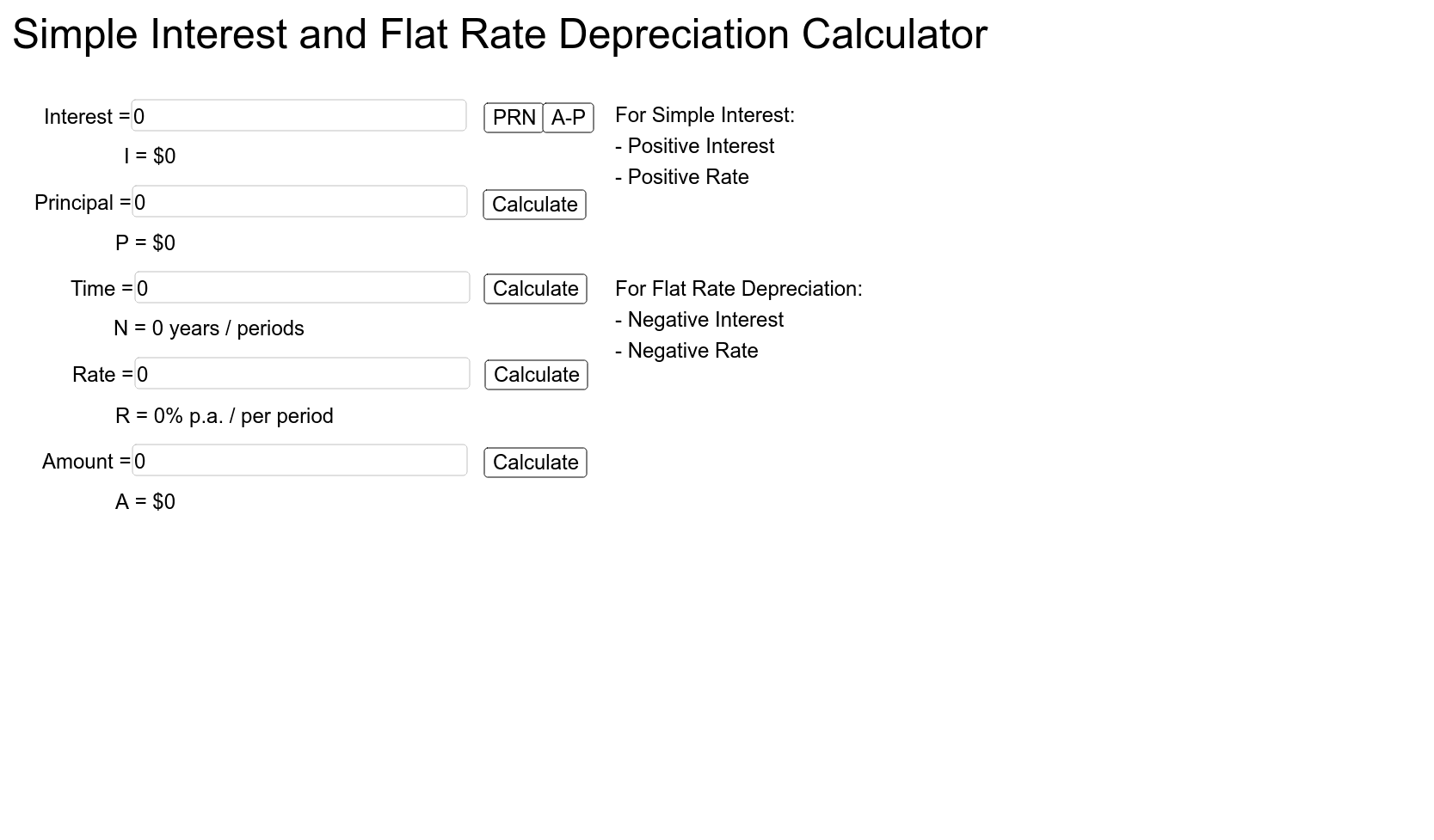

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Macrs Depreciation In Excel Formulas To Calculate Depreciation Rate Excel Formula Excel Calculator

Appliance Depreciation Calculator